An automated system is a set of rules made by computer programmers to trade if anything happens in the financial markets. Automated trading systems, also called algorithmic trading, enable traders to make specific rules for both trade entries and exits. This allows traders to build rules for both trade entries and exits that can be automatically executed via a computer.

In order to prevent the effects of human emotion on their strategies and decisions, traders and investors turn entry, exit, and money management rules into automated trading systems that enable computers to execute and monitor the trades. You can develop entry and exit rules based on simple conditions, or you can employ difficult strategies that require skills in a programming language such as Python.

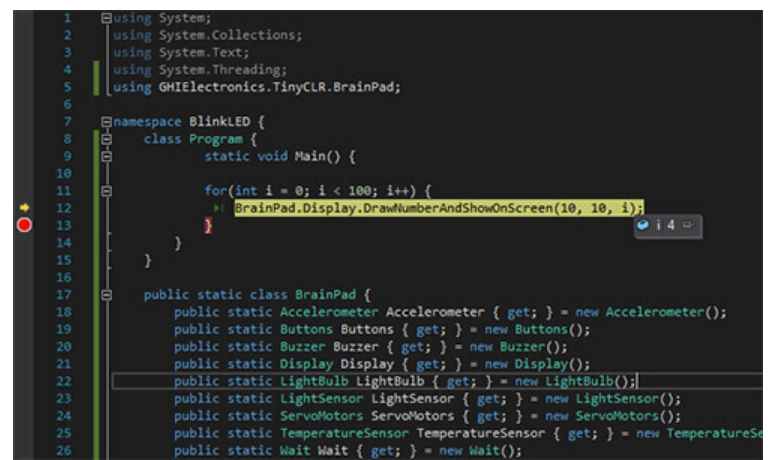

All automated systems need software linked to direct access brokers. The TradeStation platform, for example, uses an easy programming language like Python. Some trading platforms offer strategy-building wizards that help investors choose possible technical indicators to develop a set of rules to automatically trade. For example, the user has the ability to develop a long position trade that will be entered when the 50-day moving average crosses above the 200-day moving average on a five-minute chart of a particular trading instrument. The trader may also input the type of order when the trade is triggered or use the platform’s default inputs.

Automated trading systems have certain advantages, which are as follows:

- There is no doubt that human beings make their decisions under the shadow of emotions, which results in losses in trading. However, an automated trading system decreases the involvement of emotions in the decision. The automation of the trading system results in the execution of the orders without any emotional effect.

- When a trader wants to evaluate a trading strategy, he backtests it to ensure that it will give positive results. Backtesting is when a trader uses historical data and employs his strategy to see what the outcome would be if he used it in the past.

- If you use an automated system, you should not leave any type of misconception. The computer is a machine that cannot make guesses.

- Your system may be preserved in volatile markets. The traders have two big problems: they fear taking a loss and desire to get a little more profit from the trade. Automated trading creates discipline and does not permit one to make decisions without thinking.

In summary, an automated trading system provides a solution to the problem of emotions. It prevents mismanagement and appreciates trading with discipline. In addition, it performs risk management to stop losses. Another important characteristic is that it provides the opportunity to do a backtest.