When algorithmic trading emerged in the 1970s, it was not expected that it would grow rapidly and dominate the markets. An algorithm can be considered a set of instructions to solve a problem. You can call a simple algebraic equation with algebraic rules an algorithm. When computers are used as a tool to execute orders through trading instructions, the process is called algorithmic trading.

Finance helps us manage our money and investments to achieve future income targets. Financial engineering plays a crucial role in the financial markets and helps investors and traders optimize their portfolios, manage risk, and make trading algorithms.

If you want to be an expert in algorithm trading and financial engineering, you must know one of the computer languages that are used in the financial markets. Which language you should learn is a matter related to the requirements of the trading system.

The language that fulfills the requirements of present trading systems and is widely used by financial engineers is Python. Nobody can deny the importance of Python for finance and algorithm trading. What follows are the advantages of using Python in finance and trading.

Without financial analysis, you cannot understand the present state of your business. It explores the real position of your business and allows you to make decisions and make clear plans for the future. Today, financial data cannot be analyzed without computers because the data consists of large databases. The financial professionals need computers for this purpose, and to communicate with the computers, they prefer the Python language, which performs complex statistical analysis and calculations rapidly at a very low cost. Python gets benefits from its libraries, such as Pandas and Mataplotlib, which allow financial engineers to analyze and visualize big data sets and enable them to make effective strategies using big data.

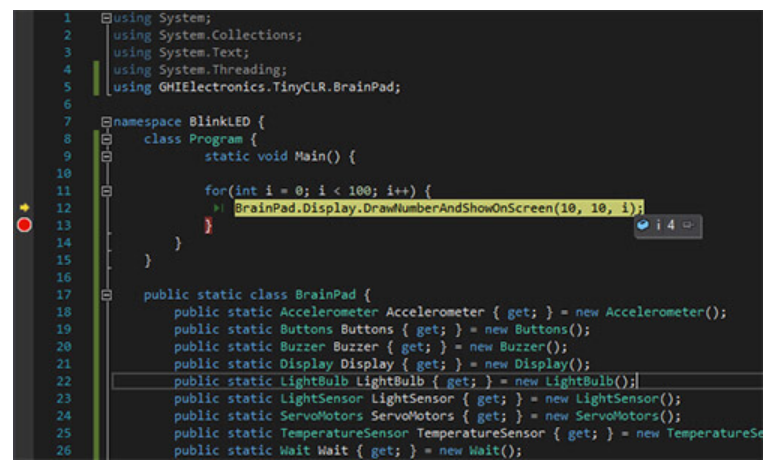

The functional programming approach provided in Python helps financial professionals make appropriate and useful algorithms. For a trading system, it is important to provide a trading platform, and Python is useful to create this type of platform. Furthermore, It is easy for beginners in trading to use Python codes. Existing modules in Python allow users to decompose them into different modules so traders can share them, and new modules can also be fixed for this language. The short code in Python makes this language unique because the coder can write their instructions in a few lines using the large libraries of Python.

The use of Python for finance and algorithmic trading is rapidly increasing. The financial engineers like it due to its easy coding. It is expected that it will rule the trading system for many more years, and thousands of professionals will continue to learn and use it.