Options are contracts that are used to get the right to either buy or sell an asset at a certain price by a specific date. In fact, options are financial derivatives whose prices are derived from the cost of their underlying security, which includes stocks, bonds, currencies, indexes, and commodities. Traders can buy or sell two types of options: call options and put options. A buyer possessing a call option can buy the underlying asset for a specific price. A buyer with a put option can sell the underlying asset for a specific price.

One of the two sides of the contract is the options writer, who writes or creates the options contract and then has the right to sell it. When an investor who buys the contract decides to use his right, the writer must fulfill the deal by buying or selling the underlying asset. If the buyer decides not to use the option, the writer does not have to do anything, and he can get the premium.

Options traders can make their trading strategies better using automated trading, and Python, one of the best computer languages, can help them. The versatility and ease of use of Python make it a popular computer language. You can do options trading using Python to achieve the following goals:

Fetching Real-time and Historical data

As a trader, you need historical data to choose your strategy. If you know using historical data that the equities will go up, You will make your strategy considering the information you got from the historical data. As financial data is time-sensitive, it is also necessary to gather recent data. Considering the importance of real-time and historical data, traders use Python to collect and analyze it. Traders can have access to data provided by Yahoo Finance using the Finance library in Python.

Options Price Modeling in Python

Python helps traders design pricing models using its robust libraries. There are various options pricing models, such as the Black-Scholes-Merton model, that can assess the theoretical price of call and put options in Europe. While binomial tree models can be used to find the price of American options.

Options Trading Strategy By Python

Python provides tools to formulate a successful options trading strategy using its robust libraries. It allows you to design, test, and implement various strategies. After defining your objectives, such as capital appreciation, income generation, and hedging, you take the first step to design your strategy, and then select the type of options. Lastly, you identify all the conditions under which you will enter and exit.

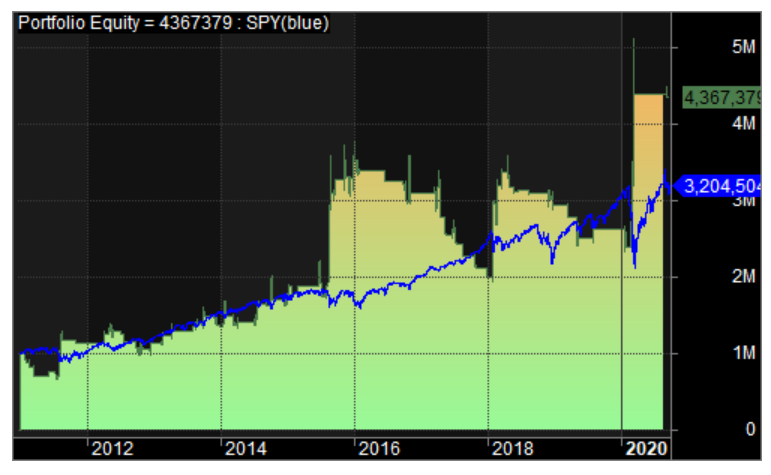

Implementing and Backtesting the Strategy

At last, you will use Python to implement your selected strategy, and then you will start backtesting your strategy, which will help you understand how this strategy has reacted in the past.

Options trading with Python is growing fast, and it is expected that Python will rule for many years.