As a trader, you know very well the significance of historical data. You can use it to predict what will happen if you buy or sell a specific number of shares at a specific time. During a day on a stock exchange when data is changing rapidly and you have to decide what you should sell or buy, it is highly important to choose the correct strategy. This is a point where backtesting can help you because it can indicate a useful strategy using historical data. For example, the backtest informs you to sell specific shares on the last Thursday of the month. The reason for choosing this strategy is an in-depth analysis of your historical data, which shows that on the last Thursday of every month, you gain profit if you sell a specific number of shares at a specific time.

Let’s see Python backtesting from another angle. We need various indicators to make decisions about our investment. One of the simple methods is to identify patterns related to price, volume, and other indicators. We can use these indicators in designing a machine-learning model to use in automated trading. One can ask us, Are you confident about your indicators? Do they work? Backtesting is a process for answering this question. The test can inform us about how these indicators worked in the past. If they did not work well in the past, we should not use them.

The steps you need to take in the backtest.

- You should choose a strategy to be tested. You should define the criteria before starting the test. If you want to test a moving average strategy, you should choose the type of moving average and the time of the moving average. You should define the time you want to exit and the time you want to enter.

- Choose the market where you will apply your strategy. You should select the market where you will trade. You have the option to test your strategy for various markets numerous times.

- Gather the required historical data about the market. Be cautious about your data because the efficiency of a backtest depends on the validity of your data.

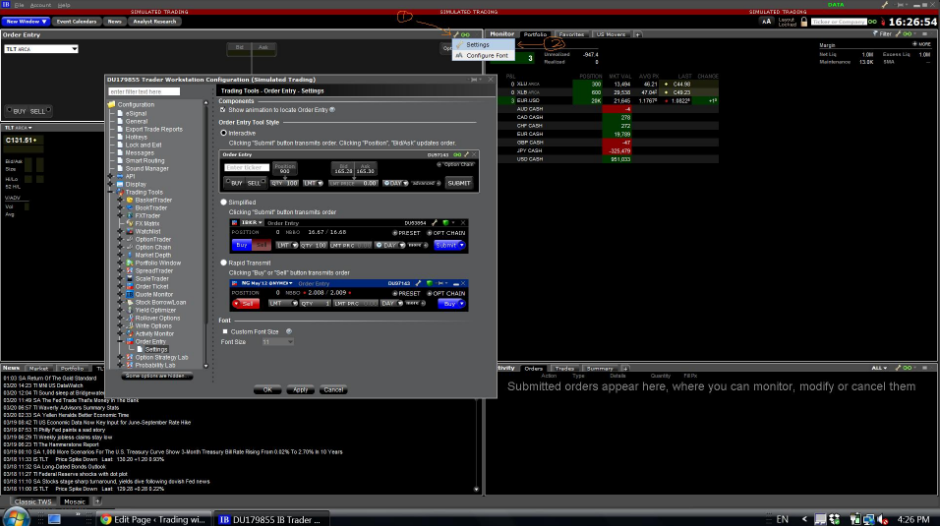

- To perform a backtest, you need to learn a computer programming language like Python.

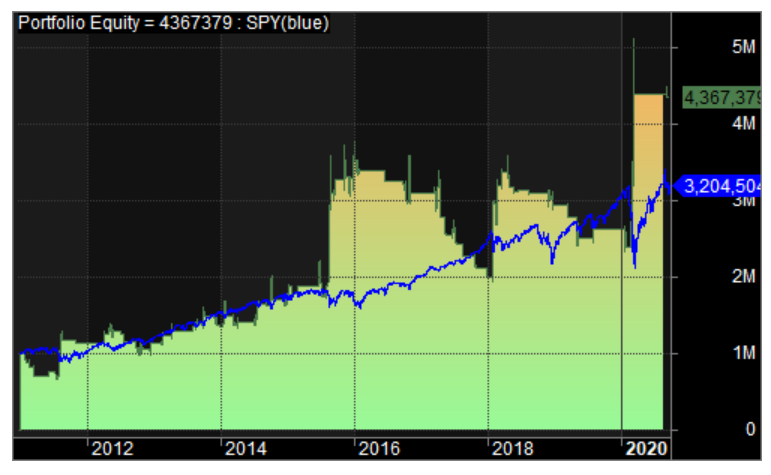

- The analysis of the backtest result is as important as the backtest. You should understand the metrics and statistics that are used in the result. For example, the profit factor shows how much profit is possible per unit of risk. If the profit factor is greater than 1, the strategy can be used because it is profitable. The maximum drawdown indicates the highest and lowest amount of capital used in backtesting. The lower maximum drawdown shows that the strategy can be used.

As a trader, you can begin simple Python backtesting, which does not require complicated Python commands. It will make you confident.