Backtesting is the process of testing a trading strategy using historical data to see how it would have performed in the past. Python has many libraries that make it easy to backtest trading strategies. One of the most popular libraries for backtesting trading strategies is called “backtrader”. Backtrader is an open-source framework for building and testing trading strategies. It is built on top of pandas, a popular data analysis library in Python, and can be used with any financial data source that provides historical price data.

Benefits of Backtest Trading Python

Backtesting trading strategies using Python has several benefits. Some of the main benefits include:

- Increased Confidence: Backtesting can give traders increased confidence in their trading strategies. By testing a strategy on historical data, traders can see how it would have performed in the past and get an idea of how it might perform in the future.

- Objective Analysis: Backtesting allows traders to objectively analyze their trading strategies. It eliminates emotional bias from the analysis, allowing traders to make decisions based solely on the performance of the strategy.

- Quick Testing: Python is a fast language, and backtesting can be done quickly. This allows traders to test many different strategies in a short amount of time, which can help them find the best strategy for their goals.

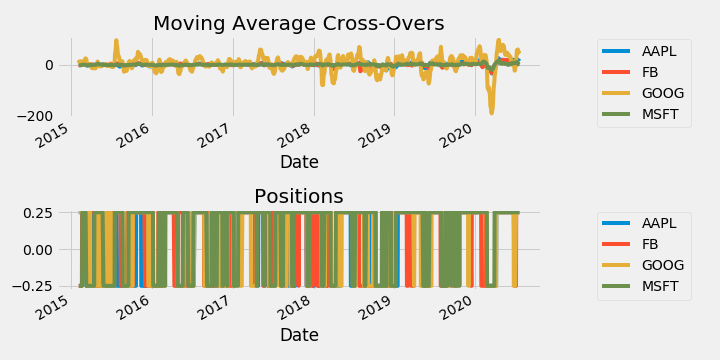

- Data Visualization: Python has many libraries for data visualization, which can help traders to understand the performance of their strategies. They can plot charts and graphs to see how their strategies have performed over time.

- Automation: Python makes it easy to automate backtesting, which can save traders a lot of time. They can set up scripts to automatically run backtests and generate reports, freeing up time to focus on other aspects of trading.

Conclusion :- Backtesting trading strategies using Python is a powerful tool for traders. It allows them to objectively analyze their strategies, gain confidence, and make data-driven decisions.