Alternatively referred to as algorithmic trading, automated trading, framework exchanging, or mechanical trading systems, automated trading systems enable brokers to establish clear guidelines for exchange routes and exits that, once adjusted, can be automatically carried out using a PC. Actually, according to various stages, computerized trading systems account for between 70% and 80% of offers made on US stock transactions.

Automated trading systems, also known as algorithmic trading, automated trading, framework exchanging, or mechanical trading systems, allow brokers to set precise rules for exchange routes and exits that can be automatically executed by a PC once they are updated. Actually, between 70 and 80 percent of offers made on US stock transactions are made by computerized trading systems, according to different stages.

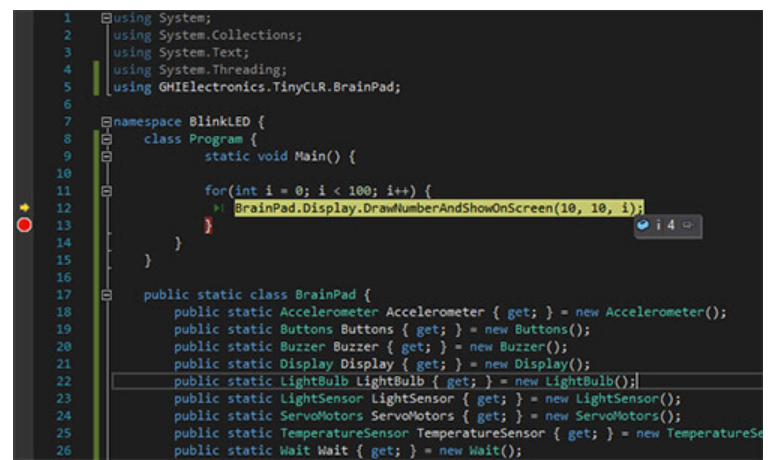

Programming linked to an immediate access representative is typically necessary for automated trading systems, and a specific standard needs to be written in the constrained language of that stage. For example, the TradeStation stage uses the EasyLanguage programming language. However, NinjaTrader leverages NinjaScript.

Advantages of Automated Systems

Reducing Emotions

Automated trading systems restrict emotions during the exchange process. Dealers typically make some simpler memories staying on course by hiding their emotions. Dealers won’t pause for thought or query the exchange because trade instructions are carried out automatically as soon as the exchange regulations are fulfilled.

Backtesting

Backtesting establishes the viability of the idea by applying trading rules to substantiated market data. All rules should be absolute when designing an automated trading framework; there should be no room for interpretation.

Keep Your Discipline

Because trade regulations are established and trade execution is carried out accordingly, discipline is maintained even in volatile industries. Exuberant factors such as fear of assuming a catastrophe or the desire to extract a little bit more benefit from a transaction can result in the loss of control.

Increasing Order Entry Velocity

When trade regulations are satisfied, automated frameworks can generate orders because computers respond rapidly to shifting economic conditions. The outcome of a trade can be significantly impacted by entering or exiting a position just moments before. The remainder of the requests, which include benefit targets and defensive stop misfortunes, are generated automatically when a position is specified.